One problem for FreshBooks users is that customers are unable to make partial payments when paying invoices online. This can make it difficult to keep track of deposits or advance payments from customers. Fortunately there are a few workarounds that make it relatively simple to bill for and keep track of these advance payments. Here is my favorite method.

Invoice for the deposit

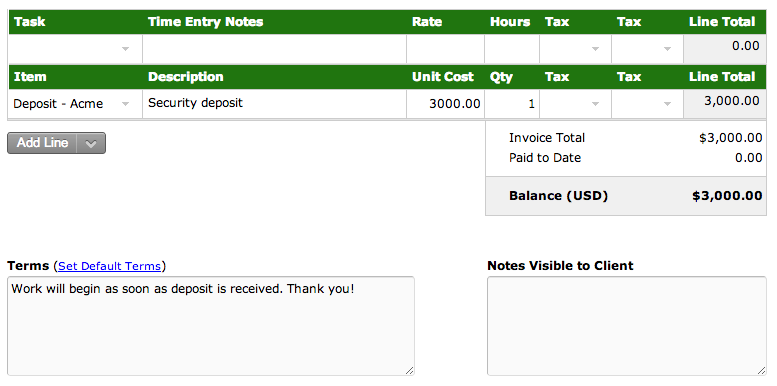

Create a new invoice. Add an item called "Deposit - XXX", where the XXX is your nickname for the client or the client's initials. Make the description as detailed as you like. Here's an example for the company Acme Supplies, Inc. My deposit item in this case is called "Deposit - Acme".

Apply the deposit

When it is time to bill for services rendered, create a second invoice.Import time entries and expenses as usual. At the bottom of the new invoice, add the same "deposit" item you used on the first invoice, but make the amount negative instead of positive. This item will offset the time and expenses billed (and hopefully bring the total due down to zero). If the customer still has part of their deposit remaining, you can put this information in the invoice notes.

Track customer deposits with the Item Sales report

If you stick to the above method, making sure to use a unique deposit item for each customer, then FreshBooks will keep track of customer deposits invoiced and applied. To view deposits on hand, go to the Item Sales report via the Reports tab.

Set the start date to a day before the first invoice. The report will give you a statement of the deposits invoiced and applied for each client, along with a balance for the deposit on hand for each client. Here is my Item Sales report after setting up invoices ACME-1 and ACME-2:

One caveat about this report: By default the report will show items billed on all invoices, not just the paid ones. This means that if you have billed for a deposit, but the invoice hasn't been paid yet, it will still show up on this report, causing the deposit amount on hand to be overstated. The solution would be to set the filter to "paid" invoices only, but FreshBooks doesn't mark zeroed-out invoices as a paid, so they won't show up. To get the invoices with a zero amount to show up when using this filter, receive a payment of zero dollars on each of the zeroed-out invoices. This will cause the status of these invoices to change from draft or sent to "paid".